It’s not just smart, the 5 best insurances that cover your sister & entire family is necessary. Most people buy health insurance to cover spouses, kids or parents, and many don’t give much thought to siblings, especially a sister who may also need the financial and emotional support of her family.

This Sister Coverage Guide is here to change all that. Regardless of whether your sister is dependent on you financially or stays in the same home, some plans in India now let you cover her through a family floater policy.

Table of Contents

5 Best Insurances That Cover Your Sister & Whole Family | Sister Coverage Guide

Let’s swim into the 5 best insurances that cover your sister & your family — and help you make the right choice.

👨👩👧👦 1. Niva Bupa Health Recharge

Best For: Customizable primary care coverage for the whole family

This plan is among top insurance policy for sister & entire family. It is a standard family floater with the option of adding siblings if they are also dependent on you.

Coverage: ₹3 lakh – ₹25 lakh

Why It’s Great:

Add up to 6 family members

Includes dependent siblings (when you declared at the beginning)

Free video consultations with medical professionals, AYUSH treatment, health ppps

📌 Sister Coverage Guide Tip: Make (sure) (her) dependency is explicitly stated on the application.

🩺 2. Care Health Insurance – Care Second ˜ Opinion plan

Best For: Access to high-value coverage for large families

This family floater provides wide coverage and is one of the 5 Best Insurances That Cover Your Sister and family.

Coverage: ₹5 lakh – ₹1 crore

Why It’s Great:

Pre hospitalization: 30 days Post hospitalization: 60 days 30 days from date of discharge; 60 days from date of discharge for all the treatments undergoing in a single day for ENT.

Organ donor, ambulance, ICU costs covered

Yearly health check-ups and health care under AYUSH

📌 Sister Coverage Guide TIP: Good choice for families residing in metro cities and wishing wide coverage even for sisters.

🌸 3. Star Health Comprehensive Family Insurance

Best For: Low-cost and reliable insurance with a name you trust

One of the more affordable and comprehensive options. It deserves to be on the best insurances that cover your sister & entire family.

Coverage: ₹1 lakh – ₹25 lakh

Why It’s Great:

Single premium to cover entire family

Maternity expansion, new born, organ donor benefit

Financially dependant on siblings with appropriate declaration.

📌 My Sister’s Coverage Guide Tip: Best for middle-income families with sisters who need medical coverage.

🌍 4. Tata AIG MediCare Premier

Best For: International doctor access with premium care

Tata AIG’s plan provides worldwide coverage and so it is one of the top 5 best insurances that cover your sister & whole family.

Coverage: ₹3 lakh – ₹20 lakh

Why It’s Great:

Cover for serious illness worldwide

Costs of air ambulances and organ donor costs

Include siblings for underwriting approval.

📌 Sister Coverage Guide Tip: Ideal for households with sisters who might be frequenting the road or demanding top-of-the-line care.

💖 5. Aditya Birla Activ Health Platinum

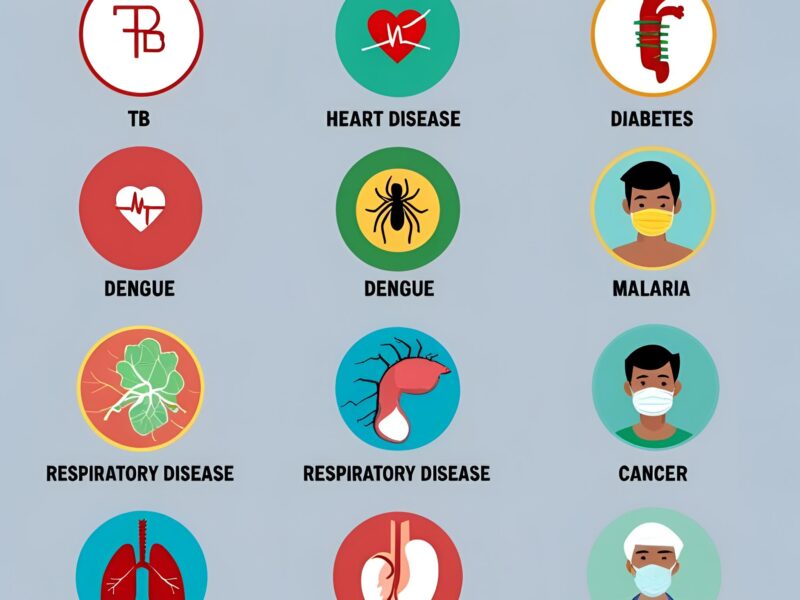

Max Medical Cover: Up to Rs.3 crore (sum assured up to Rs.2 crore + critical illness cover up to Rs.1 crore) Renewability: LIFETIME Coverage: Individual / Family It covers: All day care procedures, cataract surgery, Ayurvedic and Homeopathic (up to Rs.20,000) treatment, Organ Donor cover, Annual preventive health check up, second opinion for critical illness, etc It offers: Discount on wearable health devices, Day 1 cover for chronic diseases including infertility cover, Healthy rewards 3% sum assured to a max of Rs.50,000, AYUSH treatment(AYUSH) and organ donor cover.

Who It’s For: Health, and for long term conditions, and coverage for the whole family.

This plan is not just insurance — it incentives a healthy lifestyle. It is unarguably among its class best insurances that cover your sister & whole family.

Coverage: ₹5 lakh – ₹2 crore

Why It’s Great:

Day 1 coverage of diabetes, asthma and more

Incentives To Stay Healthy (HealthReturns™)

Mental health and wellness counseling

Dependent siblings included

📌 Sister Coverage Guide Tip: Very good if you have kids dealing with chronic health issues and prioritize preventive care.

👩👧👦 How to Add Your Sister to a Family Plan

Do you want to apply the top 5 Best Insurances That Cover Your Sister & entire family? Here’s what the typical insurers want:

✅ Your sister must be wholly or substantially financially dependent upon you

✅ She should live with you

✅ You will need evidence of relationship (birth certificate, affidavit, etc.)

If your current plan doesn’t cover that, some options to consider:

Purchase a stand alone plan for your sister

Go with any one of the above extended family floater

📌 Sister Coverage Guide Tip: Whenever you’re at the proposal stage, declare your sibling relationship to prevent issues at claim time.

✅ Final Thoughts

Don’t leave your sister defenseless in these uncertain times. The best insurances covering sister & whole family, make sure all dependents are covered, even if it extends past the standard rack of a nuclear family.

Read: How to Choose Best Sister Health Insurance Policy for Complete Family Protection – Inclusions, Benefits, Claim Process: All you need to know!

💡 Pro tip: Buy wisely, look at benefits and choose one of the 5 best insurances that cover your sister & entire family now!